ARCHIVED – Ultimate Potential for Unconventional Natural Gas in Northeastern British Columbia’s Horn River Basin

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Oil and Gas Reports 2011-1 - May 2011

Copyright/Permission to Reproduce

Materials may be reproduced for personal, educational and/or non-profit activities, in part or in whole and by any means, without charge or further permission from the National Energy Board or the British Columbia Ministry of Energy and Mines, provided that due diligence is exercised in ensuring the accuracy of the information reproduced; that the National Energy Board and the British Columbia Ministry of Energy and Mines are identified as the source institutions; and that the reproduction is not represented as an official version of the information reproduced, nor as having been made in affiliation with, or with the endorsement of the National Energy Board or the British Columbia Ministry of Energy and Mines.

For permission to reproduce the information in this publication for commercial redistribution, please e-mail the National Energy Board at: info@cer-rec.gc.ca and the British Columbia Ministry of Energy and Mines at: EnquiryBC@gov.bc.ca.

If a party wishes to rely on material from this report in any regulatory proceeding before the NEB, it may submit the material, just as it may submit any public document. Under these circumstances, the submitting party in effect adopts the material and that party could be required to answer questions pertaining to the material.

This report does not provide an indication about whether any application will be approved or not. The Board will decide on specific applications based on the material in evidence before it at that time.

BC MEM/NEB Report: Ultimate Potential for Unconventional Natural Gas in Northeastern British Columbia’s Horn River Basin

May 2011

Published by

British Columbia Ministry of Energy and Mines

PO Box 9323 Stn Prov Govt

1810 Blanshard Street

Victoria, British Columbia V8W 9N3

Web site: www2.gov.bc.ca/gov/content/governments/organizational-structure/ministries-organizations/ministries/energy-mines-and-petroleum-resources

and

The Publications Office

Canada Energy Regulator

210-517 10 Ave SW

Calgary AB T2R 0A8

Email: publications@cer-rec.gc.ca

Telephone: 403-299-3561

Telephone (toll free): 1-800-899-1265

Facsimile: 403-292-5503

Facsimile (toll free): 1-877-288-8803

Table of Contents

- Chapter 1: Introduction

- 1.1 Scope

- 1.2 Terminology

- 1.3 Units of Measure

- 1.4 Effective Date of Data

- 1.5 Updates to this Study

- 1.6 Reader’s Questions and Comments

- Chapter 2: Methodology and Results

- 2.1 Methodology

- 2.1.1 Gas in Place

- 2.1.2 Marketable Gas

- 2.2 Industry Input and Peer Review

- 2.3 Available Information

- 2.4 Geological Description

- 2.4.1 Setting

- 2.4.2 Evie Shale

- 2.4.3 Otter Park Shale

- 2.4.4 Muskwa Shale

- 2.5 Results for Gas in Place and Marketable Gas

- 2.6 Comparison with Previous Studies

- 2.7 Canadian Resources

- Chapter 3: Observations

- 3.1 General

- 3.2 Reservoir Properties of the Horn River Basin Shales

- 3.3 Access Restrictions

Appendices

List of figures and tables

Figures

- 1.1 Location of Unconventional Resources Currently Recognized in British Columbia

- 1.2 Terminology used to Describe Ultimate Potential

- 2.1 Schematic Probability Distribution

- 2.2 Depiction of Devonian Presqu’ile Barrier Reef

- 2.3 Cross-section Showing the Horn River Basin

- 2.4 Statistical Distribution of Gas in Place

- 2.5 Statistical Distribution of Marketable Gas

- A.1 A Basin Scale Distribution Superimposed on the Tract-scale Distribution

- A.2 Low, Most Likely and High Correlations Between TOC and Adsorbed Gas

Tables

- 2.1 Low, Medium and High Case Estimates of Gas in Place and Marketable Gas in the Horn River Basin

- 2.2 Breakdown of Ultimate Potential (Medium Case) for Natural Gas as of December 2010

- 2.3 Gas in Place and Marketable Gas for the Shales of the Horn River Basin

- 2.4A Current NEB Estimates of Ultimate Potential for Conventional Marketable Natural Gas in Canada (109m³

- 2.4B Current NEB Estimates of Ultimate Potential for Conventional Marketable Natural Gas in Canada (Tcf)

- 2.5A Current NEB Estimates of Ultimate Potential for Unconventional Marketable Natural Gas in Canada (109m³)

- 2.5B Current NEB Estimates of Ultimate Potential for Unconventional Marketable Natural Gas in Canada (Tcf)

- 3.1 Comparison of North American Shale Gas Basins

- A.1 Model Variables

- A.2 Summary of Model Inputs

List of acronyms and units

Acronyms

| B.C. | British Columbia |

| BC MEM | (B.C.) Ministry of Energy and Mines, the Ministry |

| BC OGC | (B.C.) Oil and Gas Commission |

| EMA | Energy Market Assessment |

| GIP | gas in place |

| NEB, the Board | National Energy Board |

| Psia | pounds per square inch absolute |

| the agencies | collectively, the NEB and BC MEM |

| TOC | total organic content |

| U.S. | United States of America |

Units

| Tcf | = trillion cubic feet |

| 109m³ | = billion cubic metres |

| °C | = degrees Celcius |

| °F | = degrees Fahrenheit |

| cf/m³ | = cubic feet per cubic metre |

| km | = kilometers |

| km² | = squared kilometres |

| kPa | = kilopascals |

| m | = metres |

Foreword

The B.C. Ministry of Energy and Mines (BC MEM, the Ministry) manages the responsible exploration and development of British Columbia’s energy sector. Part of the Ministry’s mandate is to develop tenure, royalty and regulatory policy for British Columbia’s petroleum and natural gas industry, thereby ensuring the effective and environmentally responsible management of the province’s petroleum and natural gas resources. The Ministry provides a range of petroleum and natural gas related services including the issuance of Crown petroleum and natural gas rights, royalty programs, public geosciences, and policies to address potential future resource opportunities, such as unconventional petroleum and natural gas.

The National Energy Board (NEB or the Board) is an independent federal regulator whose purpose is to promote safety and security, environmental protection and efficient infrastructure and markets in the Canadian public interest[1] within the mandate set by Parliament for the regulation of pipelines, energy development, and trade.

[1] The public interest is inclusive of all Canadians and refers to a balance of economic, environmental, and social considerations that change as society's values and preferences evolve over time.

The Board's main responsibilities include regulating the construction and operation of interprovincial and international oil and gas pipelines, international power lines, and designated interprovincial power lines. Furthermore, the Board regulates the tolls and tariffs for the pipelines under its jurisdiction. With respect to the specific energy commodities, the Board regulates the export of natural gas, oil, natural gas liquids and electricity, and the import of natural gas. Additionally, the Board regulates oil and gas exploration and development on frontier lands and offshore areas not covered by provincial or federal management agreements.

The Board also monitors energy markets, and provides its view of the reasonable foreseeable requirements for energy use in Canada having regard to trends in the discovery of oil and gas.[2]The Board periodically publishes assessments of Canadian supply and demand of energy and natural gas markets in support of its ongoing market monitoring. These assessments address various aspects of energy markets in Canada.

[2] This activity is undertaken pursuant to the Board’s responsibilities under Part VI of the National Energy Board Act and the Board’s decision in GHR-1-87.

This Energy Market Assessment (EMA), entitled Ultimate Potential for Unconventional Natural Gas in Northeastern British Columbia’s Horn River Basin, is part of a series of EMAs that provide information on the total gas resources of sedimentary basins in Canada. It is a joint assessment produced by the NEB and BC MEM (formerly British Columbia Ministry of Energy, Mines and Petroleum Resources). This series includes the NEB’s 2004 Canada’s Conventional Natural Gas Resources: A Status Report, and the 2006 report, Northeast British Columbia’s Ultimate Potential for Conventional Natural Gas, completed with the BC MEM, and the British Columbia Oil and Gas Commission. This EMA provides information on the unconventional gas resources in B.C.’s Horn River Basin and is the first in the series to describe the unconventional gas resources that are present in the country. Subsequent reports will be prepared as enough public data becomes available to perform the assessments.

During the preparation of this report, the BCMEM and the NEB (the agencies) conducted a series of informal meetings and discussions with certain companies exploring in B.C., specifically related to the Horn River Basin. The BC MEM and the NEB appreciate the information and comments provided and would like to thank all participants for sharing their time and expertise. The agencies decided the final model inputs.

If a party wishes to rely on material from this report in any regulatory proceeding before the NEB, it may submit the material, just as it may submit any public document. Under these circumstances, the submitting party in effect adopts the material and that party could be required to answer questions pertaining to the material.

This report does not provide an indication about whether any application will be approved or not. The Board will decide on specific applications based on the material in evidence before it at that time.

Executive Summary

The BC MEM and the NEB estimate supply and demand on a provincial and national scale, respectively. The ultimate potential for natural gas out of an area or sedimentary basin (how much gas is available to be produced) is recognized as a key component required to project future supply. The BC MEM’s and the NEB’s last complete study of B.C. was of the conventional resource potential and was completed in 2006, based on year-end 2003 data. The 2006 report indicated there was additional potential for natural gas in B.C. in unconventional reservoirs, but that there was not enough data to confidently estimate gas resources. That data is now starting to become available and, in 2010, the BC MEM and the NEB determined that there was sufficient data to estimate the potential of the Horn River Basin shale gas play.

This report, Ultimate Potential for Unconventional Natural Gas in Northeastern British Columbia’s Horn River Basin, is the first publicly released probabilistic resource assessment of a Canadian shale basin. The medium case estimate for marketable natural gas is 2 198 109m³ (78 Tcf). Once added to the 2006 estimate for conventional ultimate potential, and accounting for cumulative production to year end 2010 of 602 109m³(21.3 Tcf), the estimate of remaining conventional and unconventional natural gas available for future demands is 3 058 109m³ (109 Tcf). This does not consider other unconventional gas resources which are known to exist in B.C.

Introduction

Canada plays an important role in the North American natural gas market. Today, Canada provides almost one-fifth of total North American gas production, although its share has fallen in recent years. Within Canada, the province of British Columbia is an important contributor to gas supply, accounting for about 20 per cent of total Canadian production in 2009 (about 27.6 109m³ or 1 Tcf), second only to Alberta. Currently, all of B.C.’s production comes from the northeastern region of the province (Figure 1.1). Production growth in B.C. over the past ten years largely comes from development of unconventional gas (natural gas found in reservoirs requiring extensive drilling and/or production techniques), almost entirely tight gas and shale gas.

The ultimate potential for natural gas (how much gas is available to be produced out of an area) is a key component for projections of future supply. It provides basic information from which the pace of development, economics, and future production can be estimated. As drilling and completion technology advances, new information on the resource is learned, which contributes to increased certainty. It is important to note, however, that this analysis is based on current regulatory, technological, and economic conditions. The analysis in this report does not account for how future conditions may affect resource development.

1.1 Scope

This report focuses on shale gas (i.e., gas contained in shale formations), where economic recovery has been made possible by the application of horizontal drilling and multi-stage hydraulic fracturing.

This report does not specifically address the economics of discovering, developing or producing B.C.’s gas resources. Nor does it deal with the rate of discovery or productive capacity for natural gas. This report and the associated data are meant to form the basis for economic analysis and supply projections by the BC MEM, NEB or others. This joint assessment benefited from the local knowledge of the BC MEM geologists and from the input received from the various oil and gas companies pursuing development of these resources. The agencies will continue to monitor developments in the size of the resource base for natural gas in British Columbia.

Typically, some portion of a gas resource may not be accessible from the surface due to physical features such as large lakes, extreme topography, or due to alternative surface uses such as cities or parks. In northeastern B.C., most areas can be accessed through advances in horizontal drilling, where wells can reach more than two kilometres (km) sideways from the surface location. However, in some cases, access to these vertical or directional drilling locations could be precluded by restrictions on the construction of necessary access roads or by prohibitively costly permitting or mitigation requirements. Since these determinations are quite site-specific, adjustments to the ultimate potential for access restrictions were not considered for this assessment.

Figure 1.1 Location of Unconventional Resources Currently Recognized in British Columbia

1.2 Terminology

For the purpose of this report, the term ultimate potential (Figure 1.2) refers to an estimate of the volume of marketable gas reserves that will have been proven to exist in an area after production has ceased, having regard for the geological prospects of that area and anticipated technology and economic conditions.

Figure 1.2 Terminology used to Describe Ultimate Potential

| Terms | ||

|---|---|---|

| Ultimate Potential | Discovered | Cumulative Production |

| Reserves | ||

| Resources | ||

| Undiscovered | Resources | |

Discovered resources have been confirmed by wells already drilled whereas undiscovered resources are expected to be discovered by future drilling. Discovered resources consist of the volumes of gas already produced (cumulative production), the known reserves that are still to be produced, and known resources that are not yet confirmed as economic to produce under current economic conditions, but could be available under better economic conditions.

Since estimates of ultimate potential refer to a volume of gas to be discovered in the future, the estimates always have a degree of uncertainty. The amount of uncertainty varies for each component of the estimate. Undiscovered resources have the highest amount of uncertainty, since there is no specific information about them. For the discovered, there is less uncertainty, because the resource has been drilled and at least some of its characteristics have been measured. Finally, there is no uncertainty for the volumes already produced.

Additional terminology used in describing discovered resources, or in calculating estimates of the undiscovered resources and ultimate potential are as follows. Gas in place (GIP) is the initial volume of gas in the reservoir; recoverable gas is the volume of GIP that can be produced, and marketable gas is the volume of recoverable gas that remains after processing. The undiscovered GIP is reduced to marketable volumes by applying an expected recovery factor and surface loss.

1.3 Units of Measure

The data in this report are presented in metric units, followed, where appropriate, by the imperial equivalents in brackets. Natural gas volumes in metric units are at the conditions of 101.325 kilopascals (kPa) and 15 degrees Celsius (°C). For imperial units, BC MEM uses conditions of 14.65 pounds per square inch absolute (psia) and 60 degrees Fahrenheit (°F), while the NEB uses 14.73 psia and 60°F. For the purposes of this report, a conversion factor of 35.49373 cubic feet per cubic metre (cf/m³) has been used, reflecting the standard conditions used by the BC MEM. Readers requiring a conversion to the NEB conditions should use a conversion factor of 35.30096 cf/m³.

All gas volumes in this report are shown on an “as is” basis, with no adjustment for heating value.

1.4 Effective Date of Data

Work began on this study in mid-2010 and continued into 2011. Data analysis and updates were done on existing databases throughout that period and new databases specific to the ultimate potential study were developed.

1.5 Updates to this Study

Although this study accounts for drilling to year-end 2010, the release of information is sometimes slow, especially in new plays such as the Horn River Basin where the granting of Experimental Schemes by the B.C. Oil and Gas Commission (BC OGC) can add considerably to the duration of confidentiality agreements. The agencies intend to maintain the computer systems, databases, and processes used in this report to update the data on an ongoing basis. Changes may be reported in the annual releases of the BC OGC’s Hydrocarbon and By-Product Reserves in British Columbia reports or in various NEB publications.

1.6 Reader’s Questions and Comments

The reader is encouraged to contact the BC MEM or NEB with questions or comments respecting either this report or the associated data on the BC MEM and NEB websites. Please contact:

British Columbia Ministry of Energy and Mines

PO Box 9326 Stn Prov Govt

Victoria, B.C. V8W 9N3

Web site: www2.gov.bc.ca/gov/content/governments/organizational-structure/ministries-organizations/ministries/energy-and-mines

or

National Energy Board

517 Tenth Avenue SW

Calgary, Alberta T2R 0A8

Phone: (403) 292-4800

Toll Free: 1-800-899-1265

Email: info@cer-rec.gc.ca

Web site: www.neb-one.gc.ca

Methodology and Results

2.1 Methodology

The estimate of the ultimate potential for unconventional natural gas in the Horn River Basin of northeastern B.C. was determined by:

- reviewing pertinent data, relevant prior studies, and other information;

- mapping some of the geological characteristics of the Muskwa, Otter Park, and Evie shales of the Horn River Basin so that they were in a grid format based on the British Columbia drilling spacing unit (grid spacing of 1415.5 m by 1856.0 m) (see Chapter 2.4);

- using a probabilistic method loosely based on the NEB report Canada’s Conventional Natural Gas Resources – A Status Report (2004). Substantial modifications were required, however, because there is currently no provincial reserves information available with which to estimate GIP numbers in drilled sections. Therefore, GIP numbers were calculated from basic reservoir data. The new model is discussed in detail in Appendix 2;

- gathering input from industry active in the study area; and,

- relying on the expertise of the agencies.

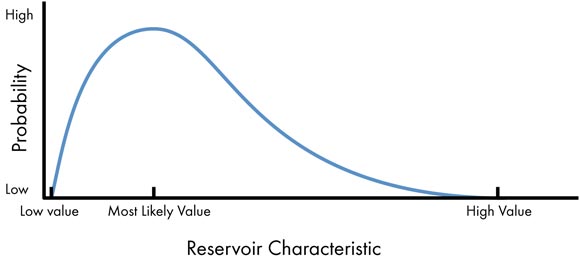

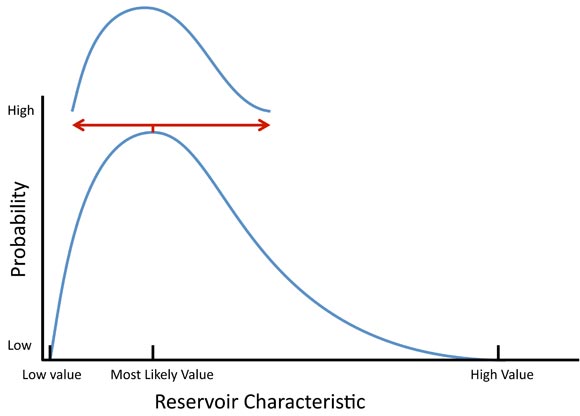

Simply put, probabilistic assessments give reservoir characteristics (like thickness, for example) a range of possibilities spread across low, most likely, and high values, where the low and high values have a low probability of occurring while the most likely value has the highest probability of occurring (Figure 2.1). Thus, in a Monte Carlo simulation where there are 500 iterations (essentially rolling the dice for each reservoir characteristic 500 times to simulate 500 potential outcomes for a single basin), it becomes possible to estimate low, expected, and high values for the gas potential of that basin (P10, Expected, and P90, respectively). This is the first publicly released probabilistic assessment of a shale gas play in Canada. As a result, comments about the methodology are welcomed.

2.1.1 Gas in Place

Natural gas in shales dominantly exists in two states: 1) free gas, where the gas is found in a gaseous state in the spaces between mineral grains or within organic matter; and 2) adsorbed gas, where the gas is weakly stuck to surfaces of the organic matter and clays. While free gas can flow freely through pore spaces and fractures, adsorbed gas must be desorbed first (become unstuck) by reducing reservoir pressure before it can flow. By understanding some of the basic, physical characteristics of the shales it is possible to estimate the amount of natural gas in the reservoir. For example, the thickness, areal extent, and the percentage of porosity in the reservoir can be multiplied together to estimate total pore space available for free gas. Also, the amount of organic matter in the rock can help determine the amount of gas that can adsorb to the shale under varying pressures.

Figure 2.1 Schematic Probability Distribution

Geological characteristics typically vary within a sedimentary basin and the amount of GIP will change from area to area. For Horn River Basin shales, geological characteristics were therefore mapped where data permitted and these maps became the basis of the assessment. GIP volumes were estimated for each tract (i.e. map-grid point) to better model how volumes changed across the basin. Tracts were summed to estimate total potential. A tract was considered discovered if it had a vertical well associated with it and if that well had any data used in any of the mapping. A tract was also considered discovered if a horizontal well was present. Otherwise, the tract was considered undiscovered. Technical details are available in Appendix 2.

2.1.2 Marketable Gas

The use of the term "marketable" implies a sense of economic recovery. However, for the purposes of this report, "marketable" refers to a technically recoverable volume under foreseeable market conditions. No rigorous economic assessment was performed for this study, though the NEB released an Energy Briefing Note in November 2010 indicating that the average cost of producing Horn River Basin shales was $4.68/GJ in 2009, not including pipeline tolls[3]. The 2010 study used a number of simplifying assumptions and its applicability to specific development is limited. In general, Horn River Basin gas would not appear to be economic at current prices, but could become more attractive if costs continue to decline, which is typical for shale gas as development proceeds.

[3] NEB, 2010. Natural Gas Supply Costs in Western Canada in 2009 - Energy Briefing Note. Available at www.neb-one.gc.ca

A grid-based method was used to estimate marketable resources in the Horn River Basin similar to that for GIP. To estimate the amount of marketable free gas, the agencies considered how much of the gas would be successfully recovered through drilling and hydraulic fracturing using current practices. Given the lack of long-term production from the Horn River Basin, free gas recovery factors are highly uncertain. For this project, recovery factors varied for each shale, but most likely values ranged between 15 and 25 per cent. The agencies also considered how much gas would be removed as gas impurities (so that the gas was of pipeline grade) and how much gas would be extracted as fuel gas to transport and process the raw gas. The amount of impurities in Horn River Basin shale gas appears to vary by shale, with some wells as low as eight per cent with others as high as 19 per cent, dominantly consisting of carbon dioxide. The impurities increase with depth.

To estimate marketable adsorbed gas the agencies considered likely abandonment pressures for producing wells and used similar recovery factors as used for free gas to determine how much of the desorbed gas could escape from the reservoir.

2.2 Industry Input and Peer Review

The agencies met with, and received input on the probabilistic methodology from experts at the Geological Survey of Canada, the United States Geological Survey, and industry.

The agencies also met individually and on a confidential[4] basis with companies and organizations actively exploring or familiar with the Horn River Basin of B.C. to increase confidence in model inputs. No information from one company was shared with another. The agencies decided the final model inputs.

[4] Confidentiality was required to protect each company’s commercially sensitive information.

2.3 Available Information

Although the Horn River Basin shale gas play is relatively new, there are many older wells that penetrated the shale while companies were exploring for deeper conventional resources. These wells provided data, such as shale depth and thickness. Newer wells are now available, including horizontal wells, though not all have been released from their confidential status. While some confidential data was used in the assessment, almost all the associated wells were to be released from confidential status by the release of this document. Altogether, 337 unique wells were used.

2.4 Geological Description

2.4.1 Setting

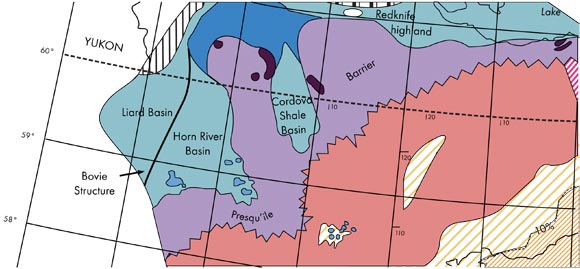

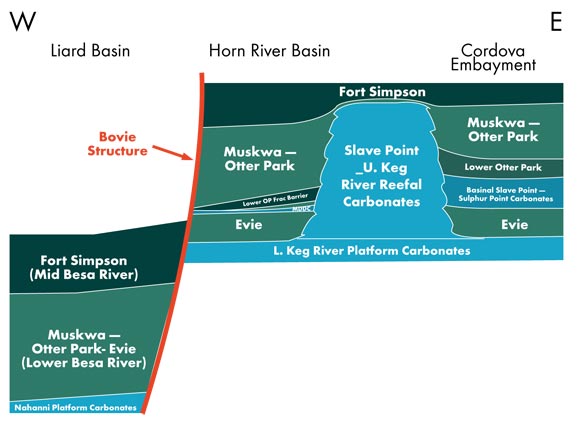

The Horn River Basin is located in northeastern B.C., and extends northward into the Northwest Territories (Figure 1.1). During the Middle Devonian period (approximately 375 million years ago), the Presqu'ile barrier reef extended from Alberta, through B.C., and into the Yukon and Northwest Territories (Figure 2.2). The reef was an area of shallow, well circulated sea-water where fine calcite mud and the skeletons of reef growing organisms were deposited and converted to limestone and dolostone after they were buried. Clays, fine siliceous (silica-rich) muds, and organic matter from dead plankton were deposited in the deeper, poorly oxygenated waters of the Horn River Basin to the west and in the Cordova Embayment to the east and were converted over time into shale deposits. In both areas, the shales have been sub-divided into, from the bottom up, the Evie, Otter Park and, Muskwa shales (Figure 2.3) and contain enough organic material to have generated natural gas. Some of the gas migrated into the Presqu’ile barrier and was locally trapped in conventional oil and gas pools.[5]

[5] NEB, 2006. Northeast British Columbia’s Ultimate Potential for Conventional Natural Gas. Available at www.neb-one.gc.ca.

2.4.2 Evie Shale

The Evie Shale consists of dark grey to black, radioactive[6], organic-rich, pyritic, variably calcareous (calcite-rich), and siliceous shale. This unit is characterized on well logs by relatively high gamma-ray readings and high resistivity. The uppermost part of the unit includes more silt and generally has lower radioactivity and resistivity. In the Horn River Basin, the Evie is over 75 m thick immediately west of the Presqu'ile barrier reef and thins westward to less than 40 m thick in the vicinity of the Bovie Lake Structure (western margin of the basin). The Evie Shale overlies limestones and dolostones of the Lower Keg River Formation.

[6] Organic-rich shales are “radioactive” in the sense that they have higher levels of radiation than other typical sedimentary rocks (during deposition, the organic matter attracts and binds dissolved uranium from sea water). The actual amount of radioactive material is extremely small. This radioactivity helps to distinguish shales from sandstones and carbonates on electric well logging tools.

Figure 2.2 Depiction of Devonian Presqu'ile Barrier Reef

Source: Alberta Geological Survey

Figure 2.3 Cross-section Showing the Horn River Basin

Source: AAPG Explorer

2.4.3 Otter Park Shale

The Otter Park Shale reaches a maximum thickness of over 270 m in the southeast corner of the Horn River Basin, where it consists of medium to dark grey calcareous shale with lower radioactivity and resistivity on well logs than the Evie and Muskwa Shales. The Otter Park thins to the north and west, and begins to include radioactive siliceous black shale beds.

2.4.4 Muskwa Shale

The Muskwa consists of grey to black, radioactive, organic-rich, pyritic, siliceous shales, and is characterized on well logs by high gamma ray readings and high resistivity. It has a gradational contact with the overlying silt-rich shales of the Fort Simpson Formation. In the Horn River Basin, the Muskwa is 30 m thick adjacent to the Presqu'ile barrier reef and thickens westward to over 60 m in the vicinity of the Bovie Lake Structure on the western side of the basin. However, the Muskwa thins considerably where the Otter Park thickness reaches its maximum in the southeast corner of the Horn River Basin. Unlike the underlying shales, the Muskwa is not restricted to the Horn River Basin, but thins and extends over the top of the barrier reef and is present through the rest of northeastern British Columbia. It is also stratigraphically equivalent with the Duvernay Shale, which extends over much of Alberta.

2.5 Results for Gas in Place and Marketable Gas

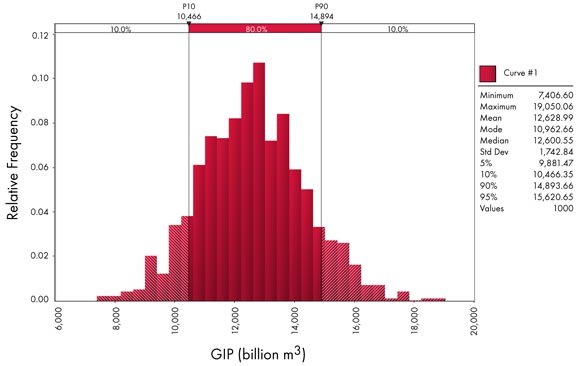

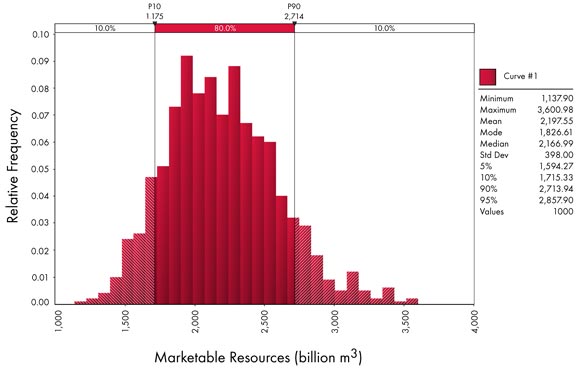

Having regard for the inherent uncertainty in estimating geological prospects and predicting gas potential, the agencies estimate the ultimate GIP in the Horn River Basin to be 10 466 109m³ (372 Tcf) to 14 894 109m³(529 Tcf), with the expected outcome of 12 629 109m³ (448 Tcf), as shown in Table 2.1 and Figure 2.4. The marketable resource base is expected to be 1 715 109m³(61 Tcf) to 2 714 109m³(96 Tcf), with the expected outcome of 2 198 109m³ (78 Tcf), as shown in Table 2.1 and Figure 2.5. The ultimate potential will very likely meet or exceed the low-case estimates. The medium case represents the most realistic outcome. The high case is possible, though unlikely to occur. A certain volume of marketable natural gas has been excluded from the assessment based on untenured land at the date of the report. The estimates of discovered and undiscovered resources are in Table 2.2 and the medium case estimate for each shale of the Horn River Basin is presented in Table 2.3.

The excluded volume in Table 2.1 represents gas that, in the opinion of the agencies, is not likely to be developed in the low and medium case estimates due to reservoir conditions assumed in those cases. In the high case estimate, the volume of gas currently considered excluded would have a higher likelihood of being developed given its size.

Table 2.1 Low, Medium and High Case Estimates of Gas in Place and Marketable Gas in the Horn River Basin

| Case | Gas in Place | Excluded Gas | Marketable Gas | |||

|---|---|---|---|---|---|---|

| 109m³ | Tcf | 109m³ | Tcf | 109m³ | Tcf | |

| Low | 10 466 | 372 | 481 | 17 | 1 715 | 61 |

| Medium | 12 629 | 448 | 639 | 23 | 2 198 | 78 |

| High | 14 894 | 529 | 805 | 29 | 2 714 | 96 |

Figure 2.4 Statistical Distribution of Gas in Place

Figure 2.5 Statistical Distribution of Marketable Gas

Table 2.2 Breakdown of Ultimate Potential (Medium Case) for Natural Gas as of December 2010

| Category | Gas in Place | Marketable Gas | ||

|---|---|---|---|---|

| 109m³ | Tcf | 109m³ | Tcf | |

| Discovered | 433 | 15 | 84 | 3 |

| Undiscovered | 12 196 | 433 | 2 114 | 75 |

| Ultimate Potential | 12 629 | 448 | 2 198 | 78 |

Table 2.3 Gas in Place and Marketable Gas for the Shales of the Horn River Basin*

| Shale | Gas in Place | Marketable Gas | ||

|---|---|---|---|---|

| 109m³ | Tcf | 109m³ | Tcf | |

| Muskwa | 3 729 | 132 | 711 | 25 |

| Otter Park | 4 486 | 159 | 666 | 24 |

| Evie | 4 024 | 143 | 562 | 20 |

[*] Numbers may not add up exactly in Table 2.2 due to stochastic adding.

2.6 Comparison with Previous Studies

The only previously published study of resource potential in the Horn River Basin[7]determined GIP resources of the Horn River Basin, Cordova Embayment, and Liard Basin, estimating GIP to be between 4 078 109m³ (144 Tcf) and more than 16 992 109m³ (600 Tcf). No attempt to break out the gas resources between basins and no estimate for marketable resources was made. The BC MEM released the results of an internal study in 2009 suggesting the Horn River Basin contained between 8 496 109m³ (300 Tcf) and 22 656 109m³ (800 Tcf) of GIP.

[7] Ross, D.J.K., and Bustin, R.M., 2008.

As described in previous NEB reports, estimates of ultimate potential generally tend to increase over time. In the Horn River Basin, the GIP of the mid-Devonian shales is not likely to increase substantially. Marketable resources may increase as more information is gained from longer term production data. Marketable resources may also increase if the cost of further development falls, or gas prices increase substantially. Further, other resources may be discovered in overlying or underlying units during the course of development.

2.7 Canadian Resources

The NEB, as part of its mandate, maintains estimates of ultimate potential for all regions of Canada. Its most current estimates of Canadian resources were provided in its joint 2008 Report Saskatchewan’s Ultimate Potential for Conventional Natural Gas. Tables 2.4 A and 2.4B show the current estimates of ultimate potential of conventional natural gas in Canada in both metric and imperial units, respectively, and are current to year-end 2009. In addition, the NEB is completing a list of ultimate potential estimates of unconventional natural gas in Canada that will be populated as assessments are completed. Tables 2.5A and 2.5B are current to year-end 2010. The combination of Tables 2.4 and 2.5 in either metric or imperial units will provide the total ultimate potential for the country.

Table 2.4A Current NEB Estimates of Ultimate Potential for Conventional Marketable Natural Gas in Canada (109m³)

Discovered Resources |

Undiscovered Resources |

Ultimate Potential[1] |

Remaining Ultimate Potential[2] |

|

|---|---|---|---|---|

Western Canada Sedimentary Basin |

||||

Alberta |

5 131 |

1 145 |

6 276 |

2 201 |

British Columbia |

1 142 |

320 |

1 462 |

860 |

Saskatchewan |

263 |

34 |

297 |

106 |

Southern Territories |

32 |

164 |

196 |

177 |

Total |

6 568 |

1 663 |

8 231 |

3 344 |

East Coast (Offshore) |

||||

Labrador |

130 |

660 |

790 |

790 |

East Newfoundland Basin |

0 |

352 |

352 |

352 |

Grand Banks |

110 |

375 |

485 |

485 |

Southern Grand Banks |

0 |

86 |

86 |

86 |

Laurentian Sub-Basin |

0 |

170 |

170 |

170 |

Nova Scotia |

147 |

505 |

652 |

608 |

George's Bank |

0 |

60 |

60 |

60 |

Total |

387 |

2 208 |

2 595 |

2 551 |

West Coast |

||||

Offshore |

0 |

255 |

255 |

255 |

Intermontane |

0 |

230 |

230 |

230 |

Total |

0 |

485 |

485 |

485 |

Northern Canada |

||||

Northwest Territories - Colville Hills |

17 |

117 |

134 |

134 |

Mackenzie-Beaufort |

254 |

1 460 |

1 714 |

1 714 |

Yukon - Eagle Plains |

2 |

28 |

30 |

30 |

Yukon - Others |

1 |

114 |

115 |

115 |

Arctic Islands |

331 |

793 |

1 124 |

1 124 |

Eastern Arctic |

0 |

140 |

140 |

140 |

Hudson Bay |

0 |

28 |

28 |

28 |

Total |

605 |

2 680 |

3 285 |

3 285 |

Ontario |

44 |

23 |

67 |

33 |

Gulf of St. Lawrence (Maritimes Basin)[3] |

4 |

36 |

40 |

40 |

TOTAL CANADA[1] |

7 610 |

7 097 |

14 707 |

9 742 |

[1] numbers may not add due to rounding

[2] as of 31 December 2009, some are 2008

[3] The Board is aware of the new Geological Survey of Canada report released in 2009 providing a larger estimate of potential gas resources in the Gulf of St. Lawrence region; however, the Board is cautious about recognizing the new estimate without additional successful drilling information.

Table 2.4B Current NEB Estimates of Ultimate Potential for Conventional Marketable Natural Gas in Canada (Tcf)

Discovered Resources |

Undiscovered Resources |

Ultimate Potential[1] |

Remaining Ultimate Potential[2] |

|

|---|---|---|---|---|

Western Canada Sedimentary Basin |

||||

Alberta[3] |

182 |

41 |

223 |

78 |

British Columbia[3] |

41 |

11 |

52 |

31 |

Saskatchewan[3] |

9 |

1 |

11 |

4 |

Southern Territories |

1 |

6 |

7 |

6 |

Total |

233 |

59 |

293 |

119 |

East Coast (Offshore) |

||||

Labrador |

5 |

23 |

28 |

28 |

East Newfoundland Basin |

0 |

12 |

12 |

12 |

Grand Banks |

4 |

13 |

17 |

17 |

Southern Grand Banks |

0 |

3 |

3 |

3 |

Laurentian Sub-Basin |

0 |

6 |

6 |

6 |

Nova Scotia |

5 |

18 |

23 |

22 |

George's Bank |

0 |

2 |

2 |

2 |

Total |

14 |

77 |

92 |

90 |

West Coast |

||||

Offshore |

0 |

9 |

9 |

9 |

Intermontane |

0 |

8 |

8 |

8 |

Total |

0 |

17 |

17 |

17 |

Northern Canada |

||||

Northwest Territories - Colville Hills |

1 |

4 |

5 |

5 |

Mackenzie-Beaufort |

9 |

52 |

61 |

61 |

Yukon - Eagle Plains |

0 |

1 |

1 |

1 |

Yukon - Others |

0 |

4 |

4 |

4 |

Arctic Islands |

12 |

28 |

40 |

40 |

Eastern Arctic |

0 |

5 |

5 |

5 |

Hudson Bay |

0 |

1 |

1 |

1 |

Total |

21 |

95 |

117 |

117 |

Ontario |

1 |

1 |

2 |

1 |

Gulf of St. Lawrence (Maritimes Basin)[4] |

0 |

1 |

1 |

1 |

TOTAL CANADA[1] |

270 |

252 |

522 |

346 |

[1] numbers may not add due to rounding

[2] as of 31 December 2009, some are 2008

[3] Converted to imperial using 35.49373 cf/m³, refer to Section 1.3

[4] The Board is aware of the new Geological Survey of Canada report released in 2009 providing a larger estimate of potential gas resources in the Gulf of St. Lawrence region; however, the Board is cautious about recognizing the new estimate without additional successful drilling information.

Table 2.5A Current NEB Estimates of Ultimate Potential for Unconventional Marketable Natural Gas in Canada (109m³)

Discovered Resources |

Undiscovered Resources |

Ultimate Potential[1] |

Remaining Ultimate Potential[2] |

|

|---|---|---|---|---|

Western Canada Sedimentary Basin |

||||

Alberta |

||||

British Columbia |

84 |

2 114 |

2 198 |

2 198 |

Saskatchewan |

||||

Southern Territories |

||||

Total |

84 |

2 114 |

2 198 |

2 198 |

East Coast (Offshore) |

||||

Labrador |

||||

East Newfoundland Basin |

||||

Grand Banks |

||||

Southern Grand Banks |

||||

Laurentian Sub-Basin |

||||

Nova Scotia |

||||

George's Bank |

||||

Total |

||||

West Coast |

||||

Offshore |

||||

Intermontane |

||||

Total |

||||

Northern Canada |

||||

Northwest Territories - Colville Hills |

||||

Mackenzie-Beaufort |

||||

Yukon - Eagle Plains |

||||

Yukon - Others |

||||

Arctic Islands |

||||

Eastern Arctic |

||||

Hudson Bay |

||||

Total |

||||

Ontario |

||||

Gulf of St. Lawrence (Maritimes Basin) |

||||

TOTAL CANADA[1] |

84 |

2 114 |

2 198 |

2 198 |

[1] numbers may not add due to rounding

[2] as of 31 December 2010

Table 2.5B Current NEB Estimates of Ultimate Potential for Unconventional Marketable Natural Gas in Canada (Tcf)

Discovered Resources |

Undiscovered Resources |

Ultimate Potential[1] |

Remaining Ultimate Potential[2] |

|

|---|---|---|---|---|

Western Canada Sedimentary Basin |

||||

Alberta[3] |

||||

British Columbia[3] |

3 |

75 |

78 |

78 |

Saskatchewan[3] |

||||

Southern Territories |

||||

Total |

3 |

75 |

78 |

78 |

East Coast (Offshore) |

||||

Labrador |

||||

East Newfoundland Basin |

||||

Grand Banks |

||||

Southern Grand Banks |

||||

Laurentian Sub-Basin |

||||

Nova Scotia |

||||

George's Bank |

||||

Total |

||||

West Coast |

||||

Offshore |

||||

Intermontane |

||||

Total |

||||

Northern Canada |

||||

Northwest Territories - Colville Hills |

||||

Mackenzie-Beaufort |

||||

Yukon - Eagle Plains |

||||

Yukon - Others |

||||

Arctic Islands |

||||

Eastern Arctic |

||||

Hudson Bay |

||||

Total |

||||

Ontario |

||||

Gulf of St. Lawrence (Maritimes Basin) |

||||

TOTAL CANADA[1] |

3 |

75 |

78 |

78 |

[1] numbers may not add due to rounding,

[2] as of 31 December 2010

[3] Converted to imperial using 35.49373 cf/m³

Observations

3.1 General

The estimate of ultimate potential for marketable unconventional natural gas in the shales of the Horn River Basin of northeastern B.C. is 2 198 109m³ (78 Tcf). The new assessment identifies a new resource available to British Columbia and Canada that can be used to meet a significant portion of natural gas demand going forward and ranks among the most prospective shale gas basins in North America (Table 3.1).

3.2 Reservoir Properties of the Horn River Basin Shales

Certain trends became evident during analysis of the data for this study. Overall, all three shale zones carry significant potential. The Otter Park, however, varies substantially across the basin, losing significant potential to the south near the Presqu’ile barrier reef, where limestone marls were deposited at the expense of shale.

3.3 Access Restrictions

The use of the @Risk model allows for an approximate determination of undiscovered resources that may be precluded from development by surface access restrictions. Due to the absence of national parks, large urban areas and large lakes in northeastern B.C., there does not appear to be any significant resource volumes that, in theory, cannot be accessed through directional drilling technology. Industry consultations did not give a clear indication that there were any resources that have been sterilized for all practical purposes due to surface restrictions. Practically however, incremental costs associated with directional drilling can have a significant impact on competitiveness.

Table 3.1 Comparison of North American Shale Gas Basins

| Parameter | Shale Gas Play |

|||||

|---|---|---|---|---|---|---|

Horn River Basin |

Montney (B.C. only) |

Barnett |

Marcellus |

Haynesville |

Fayetteville |

|

Basin Area (km2) |

11 500 |

1 600 to 10 000 |

1 900 |

95 000 |

9 000 |

9 000 |

Depth (m) |

1 800 to 3 000 |

1 000 to 3 500 |

2 000 to 2 600 |

2 500 to 3 000 |

3 000 |

350 to 2 300 |

Thickness (m) |

50 to 350 |

50 to > 300 |

15 to 182 |

12 to 275 |

75 |

16 to 180 |

Porosity (%) |

2 to 8 |

1 to 6 |

4 to 5 |

10 |

8 to 9 |

2 to 8 |

Total Organic Content (%) |

1 to 8 |

1 to 7 |

4.5 |

3 to 12 |

0.5 to 4.0 |

4.0 to 9.8 |

Reservoir hydrocarbons |

dry gas |

wet gas, dry gas |

wet gas, dry gas |

wet gas, dry gas |

dry gas |

dry gas |

Natural Fracturing |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Pressure regime |

Overpressured |

Overpressured |

Overpressured |

Normal to overpressured |

Overpressured |

Normally pressured |

Proximity to major consuming markets |

Distant |

Distant |

Close |

Very close |

Close |

Close |

GIP (billion m³) |

12 629 (10 466 to |

2 270 to 19 800 |

9 263 |

42 492 |

2 0311 |

1 473 |

GIP (Tcf) |

448 (372 to 529) |

80 to 700 |

327 |

1 500 |

717 |

52 |

Marketable (billion m³) |

2 198 (1 715 to 2 714) |

Uncertain |

1 246 |

7 422 |

7 110 |

1 178 |

Marketable (Tcf) |

78 (61 to 96) |

Uncertain |

44 |

262 |

251 |

41.6 |

State of development |

very early |

early |

medium |

early |

medium |

medium |

Notes: |

hybrid shale/tight-gas |

|||||

Source: U.S. data from U.S. Department of Energy Modern Shale Gas Development in the United States: A Primer

Conclusions

- The estimate of ultimate potential for unconventional shale gas in the Horn River Basin of northeastern B.C. is 2 198 109m³ (78 Tcf).

- Discovered resources are 84 109m³ (3 Tcf) and undiscovered resources are 2 114 109m³ (75 Tcf).

- An area in the south of the Horn River Basin is excluded from the marketable estimate because the land is currently untenured, which would presumably restrict its development.

- The remaining resources can support high drilling levels for many years in the province.

- Northeastern British Columbia now holds about 55 per cent of the reported ultimate remaining conventional and unconventional natural gas resources in the Western Canada Sedimentary Basin.

- There are a number of other unconventional natural gas plays in British Columbia and elsewhere in the country which, if developed, could substantially increase the resources available for Canadian use and export purposes. The agencies intend to assess these B.C. plays as time, data, and resources allow. The NEB also intends to assess unconventional plays elsewhere in the country.

Glossary

@Risk |

A computer program from Pallisade Corporation that adds risk analysis and modeling capabilities to Excel spreadsheets. |

Adsorbed Gas |

Natural gas that is electrostatically bonded to the organic matter within a reservoir and requires the depressurizing of the reservoir to produce. |

Basin |

A segment of the earth’s crust which has been downwarped, usually for a considerable time. The sediment in basins increase in thickness toward the centre. |

Coalbed methane, Coalbed gas, or natural gas in coal |

An unconventional form of natural gas that is trapped within the matrix of coal seams. |

Conventional Gas |

Natural gas that is found in the reservoir and produced through a wellbore with known technology and where the drive for production is provided by expansion of the gas or by pressure from an underlying aquifer. |

Discovered resource |

The quantity of gas and related substances that are estimated, at a particular time, to be initially contained in known accumulations that have been penetrated by a well bore. |

Experimental scheme |

Subject to B.C. oil and gas regulations, a scheme using methods that are untried and unproven in the particular application and that must be planned and directed towards either testing a novel process, technique or procedure in an established or new reservoir situation. |

Free Gas |

Natural gas that is found in the spaces between mineral grains or within organic matter. |

Gas in place |

The total quantity of gas that is estimated to be contained in any given pool or reservoir and includes both the portion that can be recovered and the portion that will remain in the reservoir. |

Limestone Marl |

Limestone that has been infiltrated by layers of silt or sand and which typically have poor reservoir potential. |

Marketable Gas |

The volume of gas that can be sold to the market after allowing for removal of impurities and after accounting for any volumes used to fuel surface facilities. As used in this report for undiscovered volumes, it is determined by applying the average surface loss from existing pools in that formation to the recoverable volumes of undiscovered pools of the same formation. |

Monte Carlo simulation |

A statistical method whereby a range of results and their probabilities are reached through random sampling of points on a distribution curve or curves. |

Natural gas in coal |

See coalbed methane. |

Play area |

The geographical area that contains a defined geological configuration within a stratigraphic interval. That geological configuration now contains or is expected to contain producible gas or oil if the economic conditions are right. |

Pyritic |

Rock in which pyrite is found is said to be pyritic. Pyrite forms in sedimentary rocks under varying conditions. In marine sedimentary rocks, the formation of pyrite is generally dependent on the amount of organic material present. |

Recoverable Gas |

The volume of natural gas, including any impurities that can be recovered from the reservoir as a result of natural and/or induced recovery mechanisms. As used in this report for undiscovered volumes, it is determined by applying the average recovery factor from existing pools in a formation to the undiscovered pools of the same formation. |

Recovery Factor |

A factor applied to the GIP (or oil in place) in a reservoir in order to obtain the volume of gas that can be physically recovered at the surface. |

Remaining Gas |

Remaining gas (ultimate potential minus cumulative production) represents the volume available for future market demands. |

Reserves |

Reserves are estimated remaining marketable quantities of oil and natural gas and related substances anticipated to be recoverable from known accumulations, as of a given date, based on analysis of drilling, geological, geophysical, and engineering data; the use of established technology; specified economic conditions, which are generally accepted as being reasonable, and shall be disclosed. |

Reservoir |

A porous and permeable subsurface rock layer that contains a separate accumulation of petroleum that is confined by impermeable rock or water barriers and is characterized by a single pressure system. |

Resources |

As used in this report, resources refers to the total volume of oil or natural gas that is thought to be found in an area, or to that portion of the total resources that is not penetrated by a wellbore to date, or the volume that could be found as a result of appreciation. |

Shale Gas |

A form of unconventional gas that is trapped within shale, a sedimentary rock originally deposited as clay or silt and characterised by extremely low permeability. The majority of the gas exists as free gas or adsorbed gas though some gas can also be found in a dissolved state within the organic material. |

Stratigraphic interval |

A grouping of all the productive geological formations in the province into layers of sedimentary rocks of approximately the same geological age. For example, the Klua and Evie shales are geologically different but they are of approximately the same geological age and are grouped in this study. |

Surface loss factor |

A factor applied to the gas recovered from a reservoir in order to determine the volume of gas actually available to be delivered to the market. It is generally used to account for impurities in the gas and the volume of gas used to fuel the equipment that allows for the production at a particular location. |

Tight gas |

A form of unconventional natural gas that is held in the pore space of a rock that has a lower permeability or ability to flow than usual for that type of rock. |

Ultimate potential |

A term used to refer to an estimate of the marketable resources that will be developed in an area by the time that exploratory and development activity has ceased, having regard for the geological prospects of an area, known technology and economics. It includes cumulative production, remaining reserves, and future additions to reserves through extension and revision to existing pools and the discovery of new pools. For most of this report it is used as a short form of "ultimate potential of natural gas". |

Unconventional gas |

Natural gas that is contained in a non-traditional reservoir rock that requires significant additional stimulus to allow gas flow. It may be that the gas is held by the matrix material such as coal, ice, or shale; or where the reservoir has an unusually low amount of porosity and permeability. |

Undiscovered resource |

The portion of the ultimate potential that has yet to be penetrated by a wellbore or that has yet to be proven by changes in a discovered pool’s reserves through extension or revision. |

References

Bowers, B., Conventional Natural Gas Resources of the Western Canada Sedimentary Basin, in Journal of Canadian Petroleum Technology, 2000

BCMEM, Coalbed Gas (CBG) In British Columbia: Update On Activity – November 2005, 2005

BCMEM, Gas Shale Potential of Devonian Strata, Northeastern British Columbia, 2005

BCMEMPR, Shale Gas Potential: Core and Cuttings Analysis, Northeast British Columbia, Petroleum Geology Open File 2007-01, 2007

BCMEMPR, Looking into the Future: Development in The Horn River Basin, 2009 British Columbia Oil and Gas Commission, Hydrocarbon and By-Product Reserves In British Columbia, 2003 and 2004

BCMEMPR and NEB, Northeast British Columbia’s Ultimate Potential for Conventional Natural Gas, 2006

CERI, K.J. Drummond, Canada’s Natural Gas Ultimate Potential – Defining A Credible Upper Limit, 2002

CGPC, Natural Gas Potential In Canada – 2005, A Report by the Canadian Gas Potential Committee, 2005

CGPC, Natural Gas Potential In Canada – 2001, A Report by the Canadian Gas Potential Committee, 2001

CGPC, Natural Gas Potential In Canada, A Report By The Canadian Gas Potential Committee, 1997

CSPG and ARC, Geological Atlas of the Western Canada Sedimentary Basin, Mossop, G. and Shetsen, I., Compilers, 1994

CSUG, Understanding Shale Gas in Canada, 2010

CSUG, Canada’s Unconventional Natural Gas Resources, 2010

ER and NEB, Saskatchewan’s Ultimate Potential for Conventional Natural Gas, 2008

EUB and NEB, Alberta’s Ultimate Potential for Conventional Natural Gas, 2005

GSC, Petroleum Resource Assessment, Paleozoic Successions of the St. Lawrence Platform and Appalachians of Eastern Canada, 2009

NEB, A Primer for Understanding Canadian Shale Gas – Energy Briefing Note, 2009

NEB, Canada’s Energy Future: Infrastructure Changes and Challenges to 2020, An Energy Market Assessment, 2009

NEB, Canada’s Energy Future: Reference Case and Scenarios To 2030, 2007

NEB, Canada’s Energy Future: Scenarios For Supply and Demand To 2025, 2003

NEB, Canadian Energy Supply and Demand Reports, 1993 and 1997

NEB, Natural Gas Resource Assessment Northeast British Columbia, 1994

NEB, Northeast British Columbia Natural Gas Resource Assessment 1992–1997, 2000

NEB, Canada’s Conventional Natural Gas Resources: A Status Report, 2004

AAPG, Characterizing the shale gas resources of the Devonian-Mississippian strata in the Western Canada Sedimentary Basin: Application of an integrated formation evaluation, Ross, D. and Bustin, M., 2007

W.J. Haskett, SPE, P.J. Bowers, Design Strategies Inc., Evaluation of Unconventional Resource Plays, SPE Annual Technical Conference and Exhibition, 2005

W.J. Haskett, P. Jeffrey Brown, Recurrent Issues in the Evaluation of Unconventional Resources, Search and Discovery Article #40674, January, 2011

Methodology

Introduction

Background

Like prior assessments of conventional resources, the NEB uses Monte Carlo simulations to provide a range of results of varying probabilities.

Assumptions

- Stratigraphic units are treated as individual resources and the assessment is limited to the geographic area defined as the shale basin even if the resource may extend beyond the confines of the basin.

- The resource is considered a resource play, where gas is pervasively distributed through the geologically defined play area. Thus, success at discovering the resource with a well is 100 per cent.

- No study has been undertaken to determine the economics for marketable resources and the determination of what is economic is based on the experience of the agencies.

- Recovery factors are based on existing technology, though reasonable advancements are assumed. No detailed analyses of technological advancements have been performed for this study.

Data

The data used in this study included:

- Basic well data, including location and formation tops

- Stratigraphic intervals: zones and aerial extent

- Zone evaluation: formation depth, gross pay, net pay, porosity, gas saturation, pressure, temperature, and TOC

- Fluid properties: gas or oil, Z factor, and gas contents

Stratigraphy and Area Breakdown

Stratigraphic Intervals

The project team reviewed relevant formations in the project area and divided gas-bearing horizons into stratigraphic units. For each well, reservoir parameters were estimated for each stratigraphic unit where data permitted.

Play Area

For this study, each stratigraphic unit was represented by a single play area because insufficient data prevented identification of separate areas with common characteristics. In the future, as data become more available, the shale basin may be subdivided.

Play Area tracts

Each play area was further subdivided into spacing units. For this study, 1415.5 m by 1856.0 m tracts were used because the spacing was close to the drill-spacing unit used by the BC OGC.

Resource Evaluation Process

Formulas

Shale gas (as well as coalbed methane) dominantly consists of two gas types: free gas, which is natural gas stored in pore spaces and fractures, and adsorbed gas, which is natural gas adsorbed to organic matter and clay in the reservoir. Therefore, the total natural gas stored in a shale prior to production can be determined by using the following basic equation:

GIPtotal = GIPfree + GIPadsorbed

Where:

- GIPtotal = total gas in place

- GIPfree = free gas in place

- GIPadsorbed = adsorbed gas in place

Marketable resources can be calculated with the following equation

MRtotal = MRfree + MRadsorbed

Where:

- MRtotal = Total marketable resources

- MRfree = Free marketable resources

- MRadsorbed = Adsorbed marketable resources

Further, for marketable resources, geographic components to the resource were excluded where the reservoir was considered too uneconomic to develop, as determined and mapped by the agencies.

Free gas

Because of a lack of reserves data, free gas and adsorbed gas contents were estimated from basic reservoir data extracted from well logs, core, and flow and pressure tests. A standard volumetric equation was used for free gas:

GIPfree = A × H × NtG × Φ × SG × ( (D × PG × TS) / (PS × D × TG × Z))

Where:

- GIPfree = gas in place (m³)

- A = area (m²)

- H = gross formation thickness (m)

- NtG = net pay to gross pay ratio (percentile)

- Φ = porosity (percentile)

- SG = gas saturation (percentile)

- D = formation depth (m)

- PG = pressure gradient (MPa/m)

- PS = surface pressure (MPa)

- TG = temperature gradient (degrees Kelvin)

- TS = surface temperature (degrees Kelvin)

- Z = gas compressibility (unitless)

Marketable free gas was estimated with the equation:

MRfree = GIPfree × (1 - SL) × RF

Where:

- MRfree = marketable gas in place (m³)

- SL = surface loss (percentile; includes gas impurities and fuel gas)

- RF = recovery factor (percentile)

Adsorbed gas

The following equation was used to estimate adsorbed gas:

GIPadsorbed = A × H × NtG × ρb × (1- Φ) × ( (TOC × L tO × D × PG ) / (PL + PF))

Where:

- Ρb = rock-matrix density (kg/m³)

- TOC = total organic content (percentile)

- LtO = Langmuir Volume to Total Organic Content (m³/kg)

- PL = Langmuir Pressure (MPa)

To estimate marketable adsorbed gas:

MRadsorbed = RF ×{GIPadsorbed - [A × H × NtG × ρb × (1- Φ) × ((TOC × LtO × D × PG ) / (PL + PF))]}

Where:

- PA = Abandonment pressure (MPa)

Correlated Variables

Correlations between variables are assumed to be:

- Recovery factors positively correlate to pressure, porosity, and gas saturation

- Porosity positively correlates to TOC content

Some variables were calibrated against other variables to tie them into mapped data and, therefore, give a result more based on local conditions:

- Pressure gradient was multiplied by depth to become reservoir pressure

- Temperature gradient was multiplied by depth to become reservoir temperature

- Z factor (based on a mix of typical Horn River Basin gas contents) was calibrated to depth

- Natural gas impurities were calibrated to depth and, in turn, fuel gas for processing was calibrated to natural gas impurities

Geological Mapping

The agencies mapped four major characteristics of each reservoir by constructing map grids: depth, thickness, net-to-gross pay ratio, and pressure gradient. As more data becomes available for other reservoir parameters such that characteristics can be mapped with reasonable confidence, additional parameters (for example, porosity) may be mapped in the future.

Shale thickness values and subsea values were calculated for each well in the data set and subsequently gridded using a grid interval with one grid node per tract. Depth to each shale unit was a product of subsea and digital elevation model grids.

Net shale pay was determined from a subset of wells throughout the basin, favouring wells with modern digital logs in LAS format. Cut-offs were chosen as a qualitative best approximation of pay throughout the Horn River shales. A net shale pay to gross thickness ratio was then calculated for each of the wells.

For each shale unit (Muskwa, Otter Park and Evie), the final result was a series of grids including gross thickness, net to gross ratio, and depth. A pressure-gradient map was shared for all three shales and was based on the limited amount of pressure data available in the basin.

Z-factor was calibrated to depth using a typical Horn River Basin gas content, reservoir pressures, and temperatures, using the formula:

Z = 0.000000000124093P² + 0.000004343739202P+0.656780747688992

where:

- Z = compressibility (dimensionless)

- P = reservoir pressure (kPa – dimensionless input)

Surface loss (SL) was estimated using two components: non-hydrocarbon impurity content and fuel gas for gas transport and gas processing. Non-hydrocarbon impurity contents in gas samples were plotted against formation depth to determine likely shrinkages and how they vary by depth across the basin. The following equation was used:

NHC = IG × D - b

Where:

- NHC = non-hydrocarbon impurity content (percentile)

- IG = impurity gradient (percentile per m)

- D = depth (m)

- b = Y intercept (percentile)

Fuel-gas consumption for gas transport (including future well-site gas compression) was a constant three per cent. Gas processing was based on the non-hydrocarbon impurity content: the non-hydrocarbon impurity content was multiplied by 1.5 to estimate total gas removed as impurities and fuel gas for processing.

A summary of the reservoir parameters, their correlations, and the origin of the data is available in Table A.1

Data Processing

Discovered and Undiscovered Tracts

Tracts were assigned “discovered” status if the evaluated formation was penetrated by a vertical well or if it contained the bottom-hole location of a horizontal well (in order to include resources discovered by horizontal wells). More than one formation can be produced from a single horizontal well in the Horn River Basin, however, because the shale formations are stacked on each other and hydraulic fracturing typically creates fractures that extend into adjacent stratigraphic units. Therefore, each stratigraphic unit was considered discovered where any of the three were penetrated by a horizontal well. Tracts not assigned “discovered” status were assigned “undiscovered” status. As more becomes known about the Horn River Basin and the extent of hydraulically induced fractures, it may become possible to better assign discovered and undiscovered resources in horizontal wells.

Data Extraction for Discovered Tracts from Grid

Data for reservoir-parameter modeling was extracted from the map grids and assigned to discovered tracts based on whether wells drilled through those tracts contained values used to construct the grid. For example, if a discovered tract contained a well with a net-to-gross value, the net-to-gross field for that tract would be filled with the value from the grid. In this way, if there was more than one well to a tract, the value would more likely represent the average. If no data was present in the well for that field, no grid value was assigned and the discovered tract remained null.

Using this method, data was extracted from the net-to-gross and pressure-gradient grids. Depth and thickness were considered static values and extended to all tracts whether they were drilled or not because of the relatively high certainty of these formation characteristics.

Resource Modeling

Introduction

The gas resource is estimated stochastically by applying probability-distribution curves to most of the variables in the Free Gas and Adsorbed Gas equations on a tract by tract basis. Discovered tracts use real data where present and distribution curves where absent. Undiscovered tracts are entirely assigned distribution curves for each relevant variable. Monte Carlo simulations are then run to simulate a number of random basins and the volume of gas in each random basin is the sum of its tracts. Because of the range of possibilities, it is possible to determine low, most likely, and high values for discovered and undiscovered segments of GIP and marketable resources.

Scope

The resource evaluation was integrated at two levels: 1) a tract-by-tract scale and 2) a basin scale (Figure A.1). Essentially, the tract-by-tract scale should be thought of as the potential for gas on a tract-by-tract basis. Given the possibility for a wide variety of reservoir conditions on such a small scale (just less than a square mile), where a few tracts out of a few thousand may have outlier high or low values, the range can be very wide. However, because the basin is very early in its development and there is low sampling density, the shape of any probability-distribution curve associated with that range is highly uncertain (i.e. the curve could easily be skewed one way or the other).

To simulate the uncertainty of base-curve shapes at the tract-by-tract level, a second set of distributions is applied at the basin level (i.e. a distribution of distributions[8]). This second set represents the most likely value for the basin in its entirety. As such, it has a narrower range because the overall basin is not expected to have the extreme outliers that individual tracts have within it. As the basin’s most likely value gets higher or lower for each iteration in the Monte Carlo simulation, the most likely value of the base curves at the tract level becomes higher or lower with it, thus changing their shape.

[8] Personal communication with Ron Charpentier and Troy Cook, United States Geological Survey.

Distribution curve selection

Often in resource assessments with limited sample data, triangular distributions are used to represent uncertainty because data is scarce enough to restrict the use of software “curve fitting”. However, triangular distributions are considered weak by some in that they overweight probabilities towards the tail ends of the distribution. Therefore, in this study, beta distributions were used to allow for the existence of very low probability outlier tails. The @Risk RiskBetaPERT function is a flexible beta curve that allows users to input high and low values as well as a most likely value as in a triangular distribution. The ability to input a most likely value for a Beta curve was also significant because it permitted tract-by-tract curves to have their most likely value change: the input for the most likely value could be made the basin-scale distribution curve, which then allowed the tract-by-tract curve to vary for each iteration.

Figure A.1 A Basin Scale Distribution Superimposed on the Tract-scale Distribution

Distribution curve utilization

Probability distributions were used in four ways: 1) where the mapped value was directly applied to the distribution; 2) where the distribution was directly correlated to another mapped value; 3) a mix of the previous two, and 4) stand-alone.

- Data extracted from the Net-to-Gross map grid were modeled using curve-fitting capabilities of @Risk software. Fitted curves were used to identify likely modes, averages, and low and high values. For each tract, the grid value on the map was applied to the Beta distribution as the mode (most likely). The upper and lower values for the Beta distribution were the upper and lower values likely to occur in any tract in the entire area. The curve was then shifted left or right based on the basin-scale distribution while keeping the upper and lower limits, effectively moving the peak from side to side and changing the shape of the curve.

- A linear correlation between non-hydrocarbon gas impurities and depth was created based on gas samples, which permitted for a shrinkage estimate for each tract. A distribution was integrated so the estimated non-hydrocarbon impurity contents could wander higher or lower based on upper and lower boundaries as determined from the scatter of data points.

- Data extracted from the Pressure Gradient map grid were modeled using curve-fitting capabilities of @Risk software. Curves were used to identify likely modes, averages, and low and high values. The pressure gradient value for each tract was ultimately multiplied by the corresponding depth from the depth grid to estimate the most likely pressure value. The minimum and maximum values from the curve fitting were multiplied by depth to determine the minimum and maximum pressures for each tract. The curve was then shifted left or right based on the basin-scale distribution while keeping the upper and lower limits, effectively moving the peak from side to side and changing the shape of the curve.

- Standalone probability distributions were porosity, gas saturation, recovery factor, total organic content, and the Langmuir volume to TOC ratio (whose low, most likely, and high values originated from a graph of Langmuir volumes plotted against sample depth; Figure A.2).

Static

- Z factor, Langmuir pressure, abandonment pressure, and matrix density were considered static. A static temperature gradient was multiplied by depth to estimate reservoir temperature.

A summary of which variables used distribution curves is present in Table A.1. A summary of the low, most likely, and high values for the tract-by-tract distributions and the basin-scale distributions are available in Table A.2.

Monte Carlo Simulations

Once all tracts were assigned data or distributions, a 500-iteration Monte Carlo simulation was run to determine GIP and marketable resources for each tract for both free and adsorbed gas. Tracts were summed to determine the GIP and marketable resources for the area. A spatial filter was applied to exclude gas from areas deemed too uneconomic to develop.

Summing of Results

@Risk curve-fitting capabilities were used to fit a distribution curve to the results for each shale (using Anderson-Darling statistics to determine the best fit) and the amount of GIP and marketable resources present in the Horn River Basin was summed using a 1000-iteration Monte Carlo simulation.

Table A.1 Model Variables

| Variable | Mapped (Y/N) | Probability Distribution (Y/N) | Correlations | Data source |

|---|---|---|---|---|

| Area | N | N | - | - |

| Depth | Y | N | - | Well logs, digital elevation map |

| Thickness | Y | N | - | Well logs |

| Net to Gross | Y | Y | - | Well logs; core |

| Porosity | N | Y | positive correlation with recovery factor and total organic content | Core |

| Gas Saturation | N | Y | positive correlation with recovery factor and total organic content | Best estimate |

| Pressure Gradient | Y | Y | multiplied by depth to become reservoir pressure | Production tests and well logs |

| Surface Pressure | N | N | - | - |

| Temperature Gradient | N | N | multiplied by depth to become reservoir temperature | Well log bottom-hole temperatures |

| Gas Compressibility | N | N | calibrated to reservoir pressures and temperatures | Best estimate from gas impurities |

| Gas impurities | N | Y | calibrated to depth | Gas analysis |

| Fuel gas for transport | N | N | - | Best estimate |

| Fuel gas for processing | N | N | calibrated to gas impurities | Best estimate |

| Recovery Factor | N | Y | positive correlation with porosity, gas saturation, and reservoir pressure | Best estimate |

| Shale-matrix density (0% porosity) | N | N | - | Core |

| Total organic content | N | Y | positive correlation with porosity | Core |

| Langmuir Volume | N | Y | calibrated to total organic content | Adsorbed gas tests |

| Langmuir Pressure | N | N | - | Best estimate from adsorbed-gas tests |

| Abandonment Pressure | N | N | - | Best estimate |

Table A.2 Summary of Model Inputs

| Muskwa | Otter Park | Evie | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Tract by Tract Distribution | Low | Most Likely | High | Low | Most Likely | High | Low | Most Likely | High |

| Depth (m) | based on map | ||||||||

| Isopach (m) | based on map | ||||||||

| Net to Gross (percentile) | based on map | ||||||||

| Porosity (percentile) | 0.01 | basin distribution | 0.12 | 0.01 | basin distribution | 0.11 | 0.01 | basin distribution | 0.12 |

| Gas Saturation (percentile) | 0.4 | basin distribution | 0.99 | 0.4 | basin distribution | 0.99 | 0.4 | basin distribution | 0.99 |

| Pressure Gradient (Mpa/km) | based on map | ||||||||

| Temperature Gradient (°C/km) | 50 | 50 | 50 | ||||||

| Z Factor (dimensionless) | from equation and based on depth and pressure maps | ||||||||

| Total Organic Content (percentile) | 0.005 | basin | 0.09 | 0.005 | basin | 0.09 | 0.005 | basin | 0.12 |

| Langmuir Pressure (MPa) | 5 | 5 | 5 | ||||||

| Abandonment Pressure (MPa) | 0.3 | 0.3 | 0.3 | ||||||

| Matrix Density (kg/m³) | 2 650 | 2 650 | 2 650 | ||||||

| Non-hydrocarbon impurity content y-intercept (percentile) | -0.16 | basin distribution | -0.06 | -0.16 | basin distribution | -0.06 | -0.2 | basin distribution | -0.06 |

| Impurity Gradient (percentile per m) | 0.000079807 | 0.000079807 | 0.000103829 | ||||||

| Langmuir/TOC ration (m³/kg) | 0.0000669 | basin distribution | 0.0006 | 0.0000669 | basin distribution | 0.0006 | 0.0000669 | basin distribution | 0.0006 |

| Recovery Factor (percentile) | 0.05 | basin distrubtion | 0.55 | 0.05 | basin distribution | 0.5 | 0.05 | basin distrubtion | 0.5 |

| Muskwa | Otter Park | Evie | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Basin Distribution | Low | Most Likely | High | Low | Most Likely | High | Low | Most Likely | High |

| Net to Gross (percentile) | -0.26 | 0 | +16.5 | -0.3 | 0 | +0.2 | -0.26 | 0 | +16.5 |

| Porosity (percentile) | 0.015 | 0.05 | 0.085 | 0.015 | 0.045 | 0.07 | 0.015 | 0.05 | 0.09 |

| Gas Saturation (percentile) | 0.73 | 0.85 | 0.95 | 0.73 | 0.82 | 0.925 | 0.73 | 0.82 | 0.9 |

| Pressure Gradient (Mpa/km) | -3 | 0 | +4 | -3 | 0 | +4 | -3 | 0 | +4 |

| Total Organic Content (percentile) | 0.01 | 0.035 | 0.055 | 0.0075 | 0.034 | 0.077 | 0.01 | 0.045 | 0.087 |